Africa's rapid population growth, projected to double by 2050, is transforming the continent into a significant investment destination. A recent report highlights the continent’s $2.9 trillion investment potential over the next three decades, particularly in renewable energy.

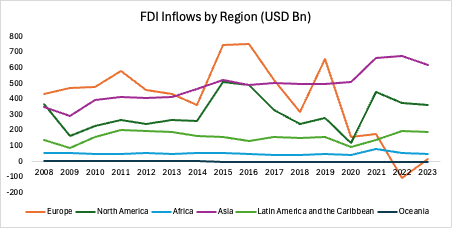

This surge is driven by the continent's abundant critical minerals, technological advancements, and the pressing need for energy infrastructure development. This represents a positive change as Africa has seen little growth in its foreign direct investment inflows in the past 15 years due to the perceived risk linked to the region’s investment landscape emanating from prohibitive governance structures, complex social norms and environmental challenges.

The Unique Dynamics of Investing in Africa

Investing in Africa comes with unique challenges that differ from those in regions like Europe or North America. The continent's cultural diversity means that values, consumer behaviours, and business practices vary widely across regions. In some areas, for example, investors must engage not only with government regulators but also with local community leaders, who play a significant role in decision-making and project acceptance.

Additionally, regulatory and socio-economic conditions differ from country to country, creating complex legal and bureaucratic landscapes that investors must navigate. For instance, while certain fast-food chains thrived in South Africa, they encountered difficulties when expanding into Eswatini due to differences in regulatory frameworks and consumer preferences.

Failing to understand these nuances can result in misaligned strategies and unsuccessful investments. To succeed in Africa, investors must ensure their objectives are aligned with the continent’s distinct market dynamics and local realities.

The Pitfalls of not Contextualising Investments in Africa

A lack of contextualisation of investment can lead to activities that, while aligned with global trends, fail to address the specific challenges and opportunities in African markets. This oversight can result in underutilised infrastructure, wasted resources, and even resistance from local communities. A prime example is the increasing global investment in artificial intelligence (AI) infrastructure. While AI-driven solutions are transforming industries worldwide, their application in Africa must be carefully considered to ensure they meet real and immediate needs.

For instance, investing in AI infrastructure to support autonomous vehicles may align with global innovation priorities, yet it remains impractical in many African regions where road infrastructure, traffic management systems, and regulatory frameworks are still developing. Conversely, AI-driven solutions in agriculture and healthcare present high-impact opportunities. In Kenya, tools like Virtual Agronomist and PlantVillage are revolutionising farming by providing personalised recommendations based on local soil and climate conditions. These technologies help farmers optimise crop yields, manage resources efficiently, and mitigate the effects of climate change.

Similarly, in healthcare, AI-powered diagnostic tools are addressing critical gaps in medical access, particularly in rural areas where healthcare professionals are scarce. Innovations like AI-assisted radiology and mobile-based diagnostic applications enable early disease detection and remote consultations, vastly improving health outcomes.

Defining a Clear Investment Purpose

Before entering the African market, investors must establish a well-defined purpose. Understanding their motivations - whether financial returns, social impact, or long-term strategic positioning - helps align investments with Africa’s economic realities. A clear purpose guides sector selection, risk assessment, and strategic planning, increasing the likelihood of long-term success.

Having a clearly defined investment purpose allows for balancing strategic objectives with the contextual realities of the target market. A well-articulated investment purpose enables investors to assess alignment with local needs and, where discrepancies exist, to develop a clear roadmap for achieving synergy. This is particularly important when balancing social impact with commercial gain - two priorities that, when effectively integrated, can drive sustainable and profitable investments, through the positive perception created that increases local support.

For example, an investor entering the African market with a commercial goal of expanding fintech solutions must consider how their product addresses financial inclusion, a key socioeconomic challenge in many regions. Simply replicating models from developed markets may not work due to different banking infrastructures, digital literacy levels, and regulatory environments. However, by aligning their investment with local realities - such as the high reliance on mobile money and informal banking networks - they can ensure both commercial viability and meaningful social impact.

Similarly, renewable energy firms investing in Africa’s solar and wind sectors must determine whether their primary goal is to generate profits, support local electrification efforts, or establish a foothold for future energy exports. Companies like M-KOPA, which provides pay-as-you-go solar energy solutions, have successfully aligned their investment strategies with Africa’s energy access challenges, ensuring both financial viability and positive social impact. Having strong local expertise and stakeholder engagement provides the necessary insights to achieve this balance.

Leveraging Local Expertise and Building Key Relationships

Partnering with local experts is essential for gaining insights into key stakeholders, business regulations, and regional contexts, enabling investors to navigate market nuances effectively. These collaborations help mitigate risks, establish credible relationships, and secure regulatory support, ultimately increasing the likelihood of investment success.

A strong example of this is the partnership between Royal Bafokeng Holdings (RBH) and Anglo American Platinum in the Bafokeng Rasimone Platinum Mine joint venture. This collaboration combined Anglo American Platinum’s mining expertise with RBH’s deep understanding of local dynamics, ensuring both operational efficiency and alignment with community interests. By directly involving local stakeholders in ownership and management, the partnership fostered sustainable development, benefiting both the local community and the broader economy.

Another successful case is Volkswagen’s investment in Rwanda’s mobility sector. Instead of simply importing vehicles, Volkswagen partnered with local businesses to introduce a ride-hailing and car-sharing service, tailoring its approach to Rwanda’s urban transport challenges. Similarly, Heineken’s expansion in Ethiopia succeeded largely due to its collaboration with local farmers, creating a sustainable barley supply chain that supported both the company and the agricultural sector.

Beyond partnerships, meaningful engagement with key stakeholders - such as government officials, community leaders, and consumers - is critical to investment success. Anglo American’s collaboration with the Royal Bafokeng community, for example, was strengthened by active engagement with local leaders, ensuring that the project aligned with community priorities. Investors who take the time to listen and work closely with these groups can secure smoother approvals, foster long-term support, and mitigate potential challenges. Conversely, neglecting these relationships can lead to resistance, operational roadblocks, and even project failure.

Crafting an Investment Message that Resonates

Once an investment is strategically positioned, effectively communicating its value becomes essential. A strong, culturally relevant narrative fosters trust and support from local communities, government authorities, and business partners. This goes beyond marketing - it requires a deep understanding of social values, economic priorities, and regional aspirations. Messaging should emphasize not only financial returns but also the broader social and developmental impact, reinforcing the investment as a driver of shared growth.

China’s large-scale investments in Africa have contributed significantly to infrastructure development, yet the way these investments are communicated has at times led to mixed perceptions. In some cases, local communities see these projects as exploitative rather than beneficial. For example, protests in Guinea against a Chinese mining firm resulted in casualties, highlighting tensions over resource extraction and community engagement. In contrast, China’s investment in Nigeria’s railway sector has been framed positively, with a strong focus on how improved transportation infrastructure is boosting economic activity and strengthening bilateral relations. These contrasting examples underscore the crucial role that effective messaging plays in shaping public perception and securing local buy-in.

One of Africa’s most pressing challenges is balancing energy security with the global shift toward net-zero emissions. Gaining public support for energy investments requires clear, well-crafted messaging that speaks to local realities. By positioning energy projects as both economic enablers and stepping stones toward long-term sustainability, investors can bridge the gap between immediate development needs and future decarbonization goals. Engaging communities to illustrate how reliable, affordable energy access improves livelihoods, drives industrialization, and lays the groundwork for a cleaner future is key. Without this, even essential energy projects may face resistance, delays, or outright rejection, despite their critical role in long-term progress.

The Way Forward

As Africa's prominence as an investment destination grows, the importance of contextualisation cannot be overstated. Investors who take the time to understand the continent's unique dynamics and align their strategies accordingly are more likely to achieve success. Central to this endeavour is the formation of robust local partnerships, which offer invaluable insights into market nuances, cultural intricacies, and regulatory landscapes. Such approaches not only yield competitive advantages for investors but also contribute to Africa's global competitiveness by fostering sustainable development and economic growth.

If you're looking to better understand how local partnerships can help contextualize your investments in Africa for greater impact and competitive advantage, feel free to reach out via email at mveli.m@africaia.com and explore how strategic collaboration can drive success in African markets.

Mar 2025 Competitiveness Infrastructure Artificial Intelligence Stakeholder Engagement Strategic Investment