The Problem: Conventional Investment Frameworks Misread Africa

Global investors continue to grapple with a fundamental challenge: how to deploy capital effectively in Africa. The continent is often described in sweeping generalisations - yet behind the headlines are over a billion people, millions of unique stories, and a tapestry of rich cultures, histories, and economies that defy simplistic categorisation.

While Africa presents some of the most compelling long-term investment opportunities, the frameworks used to assess these opportunities are often outdated or misapplied. Too many investors rely on a one-size-fits-all approach - viewing Africa as a single, homogeneous market. In reality, it is a complex ecosystem of 54 distinct economies, each with its own regulatory environment, capital needs, and growth drivers.

Investing in Africa without understanding its depth and nuance is like trying to read a novel by scanning only the chapter titles. The real opportunities lie in the details - in the informal markets powering local economies, in the shifting consumer landscapes, and in the diverse financial ecosystems that underpin growth across the continent.

This oversimplification doesn’t just distort perceptions, it leads to missed opportunities, mispriced risk, and capital deployment strategies that fail to capture the full potential of African markets. The continent’s investment landscape cannot be understood through broad strokes or standardised models. It demands a more sophisticated, locally grounded, and sector-specific approach, one that acknowledges the intricacies of each market, the interplay of formal and informal economies, and the real drivers of long-term value creation.

The Nuance: What Really Drives Commercial Outcomes in Africa?

Africa’s diversity extends beyond national borders, influencing everything from consumer behaviour to regulatory frameworks and financial markets. However, for institutional investors, this complexity presents a distinct challenge, as many of the standard risk assessment tools employed in other global markets fail to capture the full depth and nuance of African economies.

Traditional financial metrics often provide an incomplete picture. While macroeconomic indicators such as GDP growth and sovereign credit ratings offer useful benchmarks, they tend to overlook the extensive informal economy that underpins a significant share of business activity. As explored in GG Alcock’s Kasinomics, the informal sector contributes between 40% and 60% of GDP in several sub-Saharan African countries. In Nigeria, for example, estimates suggest that as much as 85% of employment occurs outside the formal sector. Overlooking these dynamics can lead to a fundamental misreading of economic potential and business risk.

An understanding of sector-specific and country-specific factors is equally important. Success in African markets rarely hinges on broad regional trends alone. In the infrastructure sector, regulatory fragmentation and political risk often create barriers to capital deployment, requiring long-term financing structures and strong partnerships with local stakeholders. Financial services present a similar duality. Although formal banking penetration remains relatively low, with only around 43% of adults in sub-Saharan Africa holding a formal bank account, fintech adoption is progressing at pace. In Kenya, for instance, nearly 80% of adults use mobile money services, driving innovation and presenting opportunities that traditional banking models frequently fail to accommodate. In agriculture, performance depends not only on commodity prices, but also on the ability to navigate fragmented supply chains, local market conditions and infrastructure challenges.

Financing structures must also adapt to local realities. Many investors struggle to structure capital effectively because they rely on conventional equity and debt instruments alone. In practice, blended finance, which combines concessional capital with private equity and debt, often offers a more appropriate and resilient framework. These models are better suited to mitigating risk, unlocking sustainable returns, and aligning with the diverse conditions found across African markets.

A more nuanced approach to investment is essential, one that aligns capital structures with on-the-ground realities, and links corporate strategies to well-defined opportunities. Market participants who recognise and embrace this connection will be better positioned to facilitate transactions that reflect both the operational needs of businesses and the risk-adjusted returns sought by investors.

The opportunity: Why Africa’s complexity is an advantage, not a challenge

Africa’s complexity is not a barrier to investment - it is the very foundation of its economic potential. While some institutional investors view fragmented markets, regulatory diversity, and informal economies as risks to be mitigated, those who structure capital with an appreciation for these dynamics gain access to high-value opportunities that are often overlooked in conventional investment models. The key is recognising that Africa’s markets are not static or one-dimensional. They are evolving rapidly, with shifting trade flows, emerging financial ecosystems, and capital needs that differ by sector and geography.

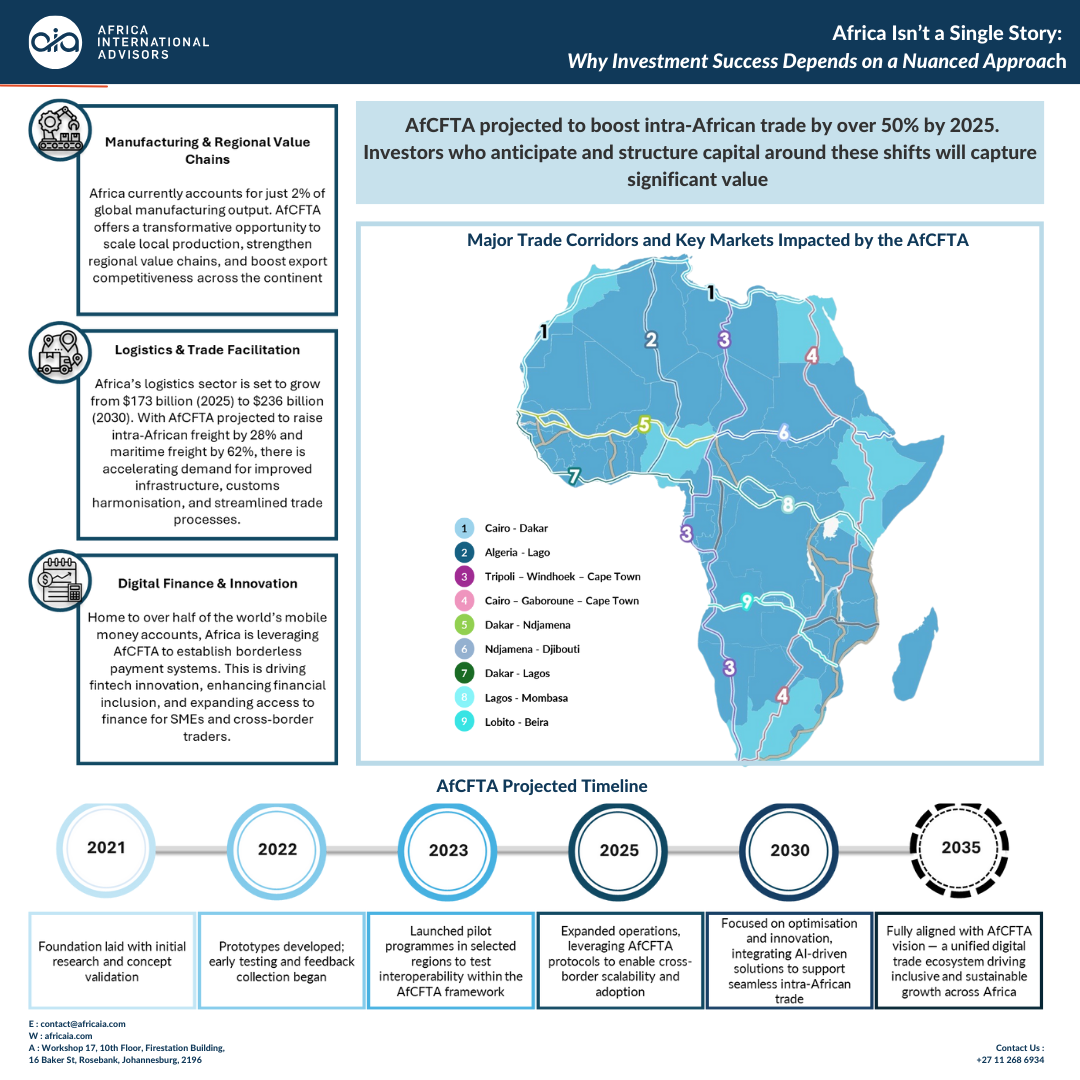

Africa’s economic transformation is unlocking new avenues for capital deployment. The implementation of the African Continental Free Trade Area (AfCFTA) is expected to re-shape trade patterns across the continent. The AfCFTA is projected to boost intra-African trade by over 50% by 2035, unlocking new growth corridors, particularly in manufacturing and logistics, driving demand for industrial capacity, logistics infrastructure, and cross-border financial solutions. Investors who anticipate and structure capital around these shifts will be best positioned to capture value.

Private capital is stepping in to address gaps left by traditional financing institutions. In 2023, private equity deal volume in Africa reached approximately $7.6 billion, highlighting the shift towards market sectors previously underserved by conventional financing, AVCA Annual Report 2023. Recent transactions such as Actis' investment in renewable energy and Helios Investment Partners' acquisition of a stake in Moroccan telecom operator Maroc Telecom, underscore the growing role that private capital is playing on the continent. As development finance institutions (DFIs) increasingly prioritise sustainability-linked investments and impact-driven mandates, private capital is playing a growing role - especially in high-growth sectors like technology, renewable energy, and consumer industries. Successfully navigating this shift requires a deep understanding of blended finance structures and risk-sharing mechanisms that align institutional capital with long-term economic objectives.

Market expertise and local partnerships have emerged as critical differentiators in Africa’s dynamic investment landscape. For example, companies such as Kenya’s M KOPA and South Africa’s GoSolr have rapidly scaled by leveraging local distribution networks and a deep understanding of consumer financing needs to deliver pay as you go solar energy solutions. Institutional investors who excel in Africa recognise that success extends far beyond traditional macroeconomic indicators or sovereign risk ratings. Instead, they harness sector-specific insights and collaborate with partners who possess a deep understanding of regulatory frameworks, political dynamics, and operational complexities. Capital structured in partnership with local expertise is inherently more resilient and better aligned with long-term growth drivers. This synergy ultimately unlocks sustainable value across Africa’s diverse markets.

Understanding how capital serves as both an enabler of corporate strategy and a driver of economic transformation is fundamental to achieving sustainable investment outcomes. Success in Africa will not be determined by broad market exposure alone; it will depend on the ability to move beyond high-level risk assessments and engage with the real business fundamentals that shape long-term value creation.

The takeaway: The future of investing in Africa requires a different playbook

Africa is not a waiting game; it is a market in motion. The continent is defined not by risk, but by reinvention - where industries leapfrog traditional models, markets evolve in real time, and returns favour those who understand not only where opportunities exist today, but where they will emerge tomorrow. The future of investing in Africa will not be written by those who apply outdated playbooks or generic risk models. It will belong to those who grasp the nuances, embrace the complexity, and structure capital in ways that align with Africa’s reality - not just its perception. It will belong to those who move beyond simplistic narratives and engage with the continent on its own terms.

Africa’s investment story is not one of waiting on the sidelines for the perfect conditions to emerge - it is about recognising that the conditions for success are already here, for those who know how to look. The question is not whether Africa is investable. It is whether investors are ready to operate at the level of depth and sophistication that the continent demands. For those who are, the opportunities are limitless.

Ready to engage with these dynamic prospects and explore how a nuanced, market-specific approach can unlock sustainable growth? Reach out to me at jamiel.c@africaia.com - I look forward to discussing how we can work together to capitalise on Africa’s exceptional potential.

Apr 2025 Investments African Competitiveness Infrastructure Strategy

Jamiel Carim

Joseph Kihara